ITT Allegedly Spent Millions To Obtain Contracts in Nigeria

|

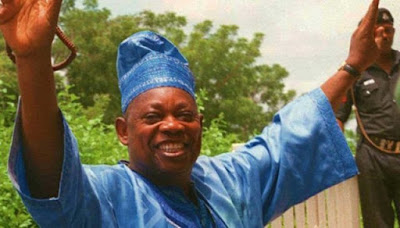

| M.O.K Abiola |

By John F. Berry August 17, 1980

International Telephone and Telegraph Corp. has made questionable payments of millions of dollars beginning in 1975 and continuing into this year to gain huge telecommunications sales contracts in Nigeria, according to ITT sources.

Central to the Nigerian payments is a politically powerful businessman named Alhaji Chief M.K.O. Abiola, who, sources say, has received large payments and has distributed some of the funds to Nigerian government officials.

By all accounts, including those of a senior ITT official in an on-the-record statement, Abiola has been paid lavishly to represent ITT interests in Nigeria.

ITT officials say the payments to Abiola have been salary and commissions which, they say, are perfectly proper because of Abiola's role as a business partner with ITT in Nigeria. Abiola, who will be 43 later this month, has the title of chairman of ITT Nigeria and owns about 40 percent of the subsidiary in his company according to ITT's general counsel.

But other ITT sources say some of the millions of dollars allegedly paid to him by the company have been spread among government officials in the ruling National Party of Nigeria (NPN). One American expert on Nigeria describes Abiola as "a very key person of the NPN."

Some ITT sources see the Nigerian arrangement as comparable to the huge questionable payments made in the early 1970s by such U.S. multinational companies as Exxon, Lockheed and Gulf to political leaders in Japan, Italy and the Netherlands, among other countries.

These sources, with first-hand knowledge, say that ITT's top management has been nervous ever since the payments began in 1975. One describes the matter as "ITT's funny bone," a source of deep concern at ITT World Headquarters in New York City.

The Nigerian payments have been made through an ITT subsidiary in Switzerland, ITT Standard S.A. Sources say Swiss secrecy laws have kept records of the Nigerian payments out of reach of the U.S. Securities and Exchange Commission. These sources also note that money brought into Nigeria would have to be declared under that country's tax laws.

These payments could involve violations of American securities laws and antibribery statutes.

Under the securities law, companies must publicly disclose any questionable financial transactions.

The Foreign Corrupt Practices Act of 1977 makes it a crime for an American company or any individual acting on its behalf to make payments to an official of a foreign country in exchange for assistance in obtaining business. According to sources, ITT's payments have continued after the effective date of the act.

ITT was asked to arrange an interview with Abiola for this report. An ITT spokesman said, however, that Abiola, a Moslem, had been celebrating Ramaden, the Islamic holy period of prayer and fasting. The spokesman added that after Ramaden, Abiola said he would be too busy to answer questions.

Howard J. Aibel, ITT's general counsel and senior vice president, says one of his "principal responsibilities" is making sure the company complies with the law and its own directives forbidding any sort of illegal or questionable business activities.

As chief internal policeman for ITT, Aibel states unequivocally that there have been no questionable payments and says that the ITT-Abiola relationship is perfectly proper.

During an interview, Aibel said: "All of the top management, including our board of directors, are familiar with the arrangements with Chief Abiola. And they've been a matter of some scrutiny and concern. We're watching them. We pay him a lot of money. We've gotten a big benefit out of the arrangement. We think we have done a very honest and honorable job in supplying equipment in Nigeria and have brought real value to that country."

In most of the overseas payments scandals uncovered in the mid-1970s, there was a great deal of ambiguity about the relationships between mulitnationals and political leaders in the country where the corporations did business.

The allegations of Nigerian payments come at a time when ITT is concluding its third internal investigation of questionable payments in about five years. The current investigation, which was part of a 1979 settlement of a suit brought against ITT by the SEC, is meant to look into payments from 1971 through 1975, the year in which the alleged Nigerian payments began.

However, Edwin A. Kilburn, an ITT assistant general counsel working on the investigation, says that the current probe does not stop at 1975 but continues right up to the present "to make sure we aren't violating the law."

The Washington Post obtained a copy of a 77-page draft report of this investigation dated March 28. There is no explicit mention in the report of the alleged Nigerian payments.

According to the draft, the investigative committee found that ITT employes made a total of $13 million in questionable payments since 1971. Of that amount, $8.7 million was disclosed in 1978 after the last probe, with the balance uncovered during the current investigation.

But one highly placed ITT source calls even the revised figure of $13 million "preposterous" because it's so low. If the questionable payments to Nigeria were included, he says, they alone would add "tens of millions of dollars" to the total.

In the draft report, the committee acknowledges that it was "assured" by the European subsidiaries that they are "in current compliance with current ITT policies and the Foreign Corrupt Practices Act of 1977."

The committee also recognizes the difficulty in tracing certain kinds of financial transactions. "Three problems of financial control noted by the committee were the use of bank accounts not subject to normal audit control, large cash transactions and the use of fictitious invoices," the draft report states.

In addition to its own internal probes, ITT for more than a decade has been the focus of numerous investigations by various law enforcement agencies, as well as the Watergate Special Prosecutor Force. During the Nixon administration, ITT allegedly sought to buy influence in the White House on an anti-trust case, as high-lighted by the famous memo written by former ITT employe Dita Beard and to finance those opposed to Chilean Marxist Salvador Allende.

A federal grand jury here has been probing ITT's alleged questionable financial dealings with government officials in Indonesia, according to sources. That investigation reportedly is winding down and indictments are not expected.

With products ranging from communications cables to Sheraton hotels, from Hostess Twinkies to Scott's grass seed, ITT's sales in 1979 were $17 billion, ranking it No. 11 on the Fortune list of the 500 biggest U.S. industrial corporations.

The telecommunications group is the biggest division of ITT, and the Nigerian telecommunications deal is one of the biggest contractual packages ever handled by ITT's telecommunications group.

Abiola's emergence as ITT's man in Nigeria is described in the October-November 1971, issue of a publication called Nigerian Business Digest. In an article, Abiola is desribed as having grown up in the western region of that country. Abiola says in the article that in the mid-1950s his mother died and his father "had trouble in his produce business."

As a result, says Abiola, "I had my whole family to support."

In the early 1960s, he says in the article, he got a scholarship to Glasgow University in Scotland, where he was trained in finance and economics. Returning to Nigeria, he went to work for Pfizer Inc., in 1967 as a controller in its agricultural division.

A Pfizer spokesman at the company's New York headquarters confirmed that Abiola worked for the firm. The spokesman quoted a Pfizer manager as recalling that Abiola was "very bright" and that he left the company for "a better opportunity."

That opportunity was to go to work in 1969 for ITT as controller in its Nigeria operations, where he has since risen rapidly to managing director and then to chairman and major shareholder.

Abiola's precise employment status at ITT is difficult to pin down, however. For example, Juan C. Capello, ITT's director of public information, says Abiola is a "Consultant" to ITT. This suggests that Abiola wears two hats -- one as chairman or employe of ITT, the other as a consultant to the same company.

One thing is clear, however -- Abiola, who describes himself in the 1971 article as being extremely hard-pressed financially through most of the 1960s, has gained immense wealth during his decade with ITT. He also has acquired the honorary Nigerian title of "chief," which was not mentioned in the 1971 article.

ITT's general counsel, Aibel, says of Abiola: "He is a businessman of substance in that country . . . and he has business interests not only in Nigeria but elsewhere in the western world. He owns a daily paper, a Sunday paper, a leading commercial bakery, and he's very much an entrepreneur."

One highly placed ITT source said that he knew that Abiola recently had $8 million in an account at a London bank, as well as funds deposited in Swiss accounts.

Aibel, who says he is charged with investigating and rooting out illegal or questionable payments, says he sees no indication that Abiola is a conduit for payoffs.

"We believe very strongly that there is absolutely no evidence whatsoever that Chief Abiola has paid any government officials anything in connection with these contracts," Aibel said during an interview. "He has given us a commitment that none of his compensation would be paid to anybody in government. He has assured us he would act in conformance with the [Nigerian] law. He has agreed that he would give us certification of his compliance with that provision as well as others at our request, and he has done so.He has agreed that he will declare his commissions received as income and pay taxes and provide us with certification that that's the case. And he has done so."

ITT declined to produce these documents for review or to say how much money Abiola has been paid. ITT spokesman Cappello quoted general counsel Aibel as saying: "These certificates exist. But since they are private documents between the company and an outside consultant, we feel it would be improper to disseminate copies."

Under the terms of the 1975 contracts with the Nigerian government, ITT was to be paid $160 million for providing Nigeria with a modern telephone system, including telephone exchanges, central office equipment and personnel training.

The equipment is manufactured by ITT European subsidiaries, including Bell Telephone Manufacturing S.A., Belgium; Standard Elektrik Lorenz AG, West Germany; Standard Telephones and Cables Ltd., Britain, and Fabbrica Apparecchiature Per Cumunicazioni Electtriche Standard, Italy.

Most of the equipment is then sold, including mark-up, to Standard S.A., the ITT Swiss subsidiary, sources say. The Swiss company, in turn, adds another mark-up and bills the Nigerian government.

The sources allege that a portion of the money paid through the ITT Swiss subsidiary by the Nigerian government finds its way to Abiola and from him into secret bank accounts maintained there for other Nigerian officials.

So-called "escalation payments" have increased the original $160 million contract package by at least $100 million. But Aibel says there is nothing unusual about dramatically escalating charges. "It's very common in American industry on any piece of equipment that's custom built and takes a period of time to complete," he says.

While the alleged questionable payments to the Nigerians by ITT could be the largest amount ever paid in one country by an American company, it is just the most recent such case involving ITT. And ever since the SEC first began probing alleged questionable payments by ITT some six years ago, the company has relentlessly fought disclosing details.

In 1975, reacting to pressure from the SEC, ITT's management conducted the first internal investigation and came up with $3.8 million in questionable payments. But the SEC, in a subsequent court filing, labeled that figure "false and misleading" and charged there had been a "substantally greater amount" of payments.

A second internal investigation was conducted -- this one by a special review committee which, in a 1978 report, said the 1971-1975 payments total was $8.7 million. ITT reported this figure to the SEC. But the SEC wanted ITT to make additional disclosures to company shareholders about the payments and went to court in 1978 to force the issue.

After the SEC filed suit, ITT took the case to the Supreme Court in an effort to stop the SEC from making public material that contained new allegations about the payments.

But in November 1978 the SEC prevailed and the complaint was made public. It alleged that $8.7 million went to government officials and others in Indonesia, Iran, the Philippines, Algeria, Mexico, Italy, Turkey, Chile, as well as Nigeria. The SEC complaint did not specify how much allegedly was paid in each country.

In August 1979, ITT and the SEC settled the suit and as part of that settlement the company agreed to the current investigation.

The new investigation has been conducted by the same special review committee -- and supporting lawyers and accountants -- that handled the last investigation made public in 1978.

Specifically, for the new investigation, ITT agreed to seek disclosure about the payments from the four European subsidiaries, which ITT claimed had refused to cooperate with earlier probes.

Three of these subsidiaries -- including ITT Standard S.A. -- are involved in the Nigerian telecommunications contracts.

Three members of the ITT board of directors, who are not executives of the company, are in charge of the current special review committee investigation. The committee is headed by ITT director Terry Sanford, the former governor of North Carolina and now president of Duke University. Efforts to reach Sanford for comment were unsuccessful.

In the draft report obtained by The Post, Sanford and his fellow committee members -- Thomas W. Keesee Jr. and Frederic C. Hamilton, both businessmen -- say that the payments, as a percentage of ITT's total sales, are insignificant.

"The new total" of $13 million "represents only .00026" of ITT's worldwide sales from 1971 to 1975, the report notes.

There is also a "review person" who is charged with evaluating the findings of the review committee. ITT and the SEC agreed on Yale University Law School Dean Harry H. Wellington for the job.

According to the SEC settlement, if Wellington is not satisfied with the report and its supporting documents, he can seek permission from the legal affairs committee of ITT's board of directors to conduct his own investigation.

If the committee turns him down, then he can seek a court hearing. This in turn, could lead to the collapse of the settlement of the ITT suit and the reopening of the SEC investigation.

Comments

Post a Comment